reverse tax calculator quebec

How to Calculate Reverse Sales Tax. To calculate the subtotal amount and sales taxes from a total.

![]()

Sales Tax Canada Calculator On The App Store

Lets calculate this value.

. Do you like Calcul Conversion. Reverse Sales Tax Formula. Calculate the total income taxes of a Quebec residents for 2021.

Province of Sale Select the province where the product buyer is located. Now you divide the items post-tax price by the decimal value youve just acquired. Your average tax rate is 220 and your marginal tax rate is 353.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Choose which one you are using in the drop-down menu. The calculator include the net tax income after tax tax return and the percentage of tax.

Cependant vous pouvez donner plus ou moins en fonction de la qualité du service reçu. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. Subtract the price of.

Type of supply learn about what supplies are taxable or not. Where the supply is made learn about the place of supply rules. Divide the price of the item post-tax by the decimal value.

The resulting amount includes GST and QST. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Obtenez le calculateur les formules et le tableau des taux de taxation.

A tax credit in Canada directly reduces the income tax you must pay. The period of reference or the tax year used in this tool is from january 1st 2021 to december 31 2021. The rate you will charge depends on different factors see.

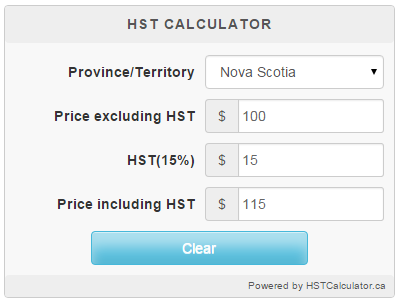

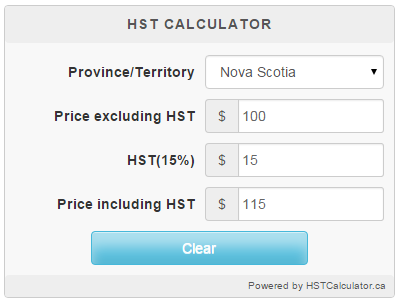

Le TIP est au moins égal à la somme des taxes TPSTVQ soit 15. Who the supply is made to to learn. Calculates the canada reverse sales taxes HST GST and PST.

For example a 1000 tax credit can directly be applied to lower the tax you need to pay by the same amount. The following table provides the GST and HST provincial rates since July 1 2010. Tax reverse calculation formula.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Calcul taxes TPS et TVQ au Québec. Reverse tax calculator quebec Friday March 11 2022 Edit.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. Now I want to calculate the tax from the total cost. 2675 107 25.

Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. Reverse GST Calculator. For example total cost is 118 i need a help for the formula to work back 10099118.

Ensure that the Find Subtotal before tax tab is selected. This reverse sales tax calculator will calculate your pre-tax price or amount for you. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount.

Following is the reverse sales tax formula on how to calculate reverse tax. You will need to input the following. I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 10099118.

For the reverse calculation GST and QST you must take the amount with taxes and divided by the combined rate of 114975 to obtain the original amount without the two taxes. Provinces and Territories with GST. This will give you the items pre-tax cost.

That means that your net pay will be 40568 per year or 3381 per month. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Sales tax amount or rate.

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca Reverse Sales Tax Cwl Canada Sales Tax Gst Hst Calculator Wowa Ca Property Tax Calculator Ppr By Davie Apps Ltd Home Closing Cost Calculator 2022 Wowa Ca. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

Enter the final price or amount. For provinces that split GST from PST such as Manitoba Quebec and Saskatchewan a No PST checkbox will appear. 13 rows Overview of sales tax in Canada.

If you have a tax bill worth 13000 you can use the 1000 to reduce your payment to 12000. If youre looking for a reverse GST-only calculator the above is a great tool to use. You simply multiply the amount before taxes obtained by 5 for the amount of GST and multiply by 9975 for the amount of QST.

The Harmonized Sales Tax or HST is a sales tax that is. Calcul inversé des taxes tps et tvq du Québec en 2022. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850.

This marginal tax rate means that your immediate additional income will be taxed at this rate. GSTHST provincial rates table. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate.

The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. This is the after-tax amount. Most states and local governments collect sales tax on items that.

Mortgage Payment Rate Calculators True North Mortgage

Reverse Hst Calculator Hstcalculator Ca

Compare And Save Calculator 2022

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Nova Scotia Hst Calculator Hstcalculator Ca

How Do You Calculate Sales Tax And Tips In Canada

Canada Sales Tax Calculator By Tardent Apps Inc

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Pst Calculator Calculatorscanada Ca

![]()

Quebec Sales Tax Calculator On The App Store

Canada Sales Tax Gst Hst Calculator Wowa Ca

2021 2022 Income Tax Calculator Canada Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Manitoba Gst Calculator Gstcalculator Ca

Avanti Gross Salary Calculator

Pst Calculator Calculatorscanada Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada